What is C-PACE?

Commercial Property Assessed Clean Energy or C-PACE can be used to finance energy-and water-related improvements of a real estate project. Budgetary items including but not limited to the HVAC, lighting, roofing and building envelope that are designed above and beyond base building code are considered qualified expenses. Renewable energy projects including solar and battery storage are also eligible for C-PACE financing.

The program starts with state-level government policy that classifies the clean energy upgrades as a public benefit similar to new sewer, water line or road. The C-PACE is repaid as a benefit assessment on the property tax bill over a term that matches the useful life of improvements and/or new construction infrastructure (typically ~20-25 years). The assessment transfers on the sale of the property and can be passed through to tenants where appropriate.

The program is currently launched and operating in 24 states with enabling legislation in a total of 37 states.

Image Source: PACENation

When Should I Use It?

New Construction and gut rehabs are strong applications for C-PACE as all of the major energy and water improvements are being installed and/or replaced.

Developers

If you are using preferred equity and or mezzanine financing C-PACE will be accretive to your deal. It is fixed rate, long term, non-dilutive and non-recourse with rates routinely under 6% on a 20-25 year term and amortization.

Bankers

C-PACE is a great application for your cost constrained, ground up construction and gut rehab projects. C-PACE is also able to boost project returns for deals that are stuck because they are falling short of a developer’s hurdle rate.

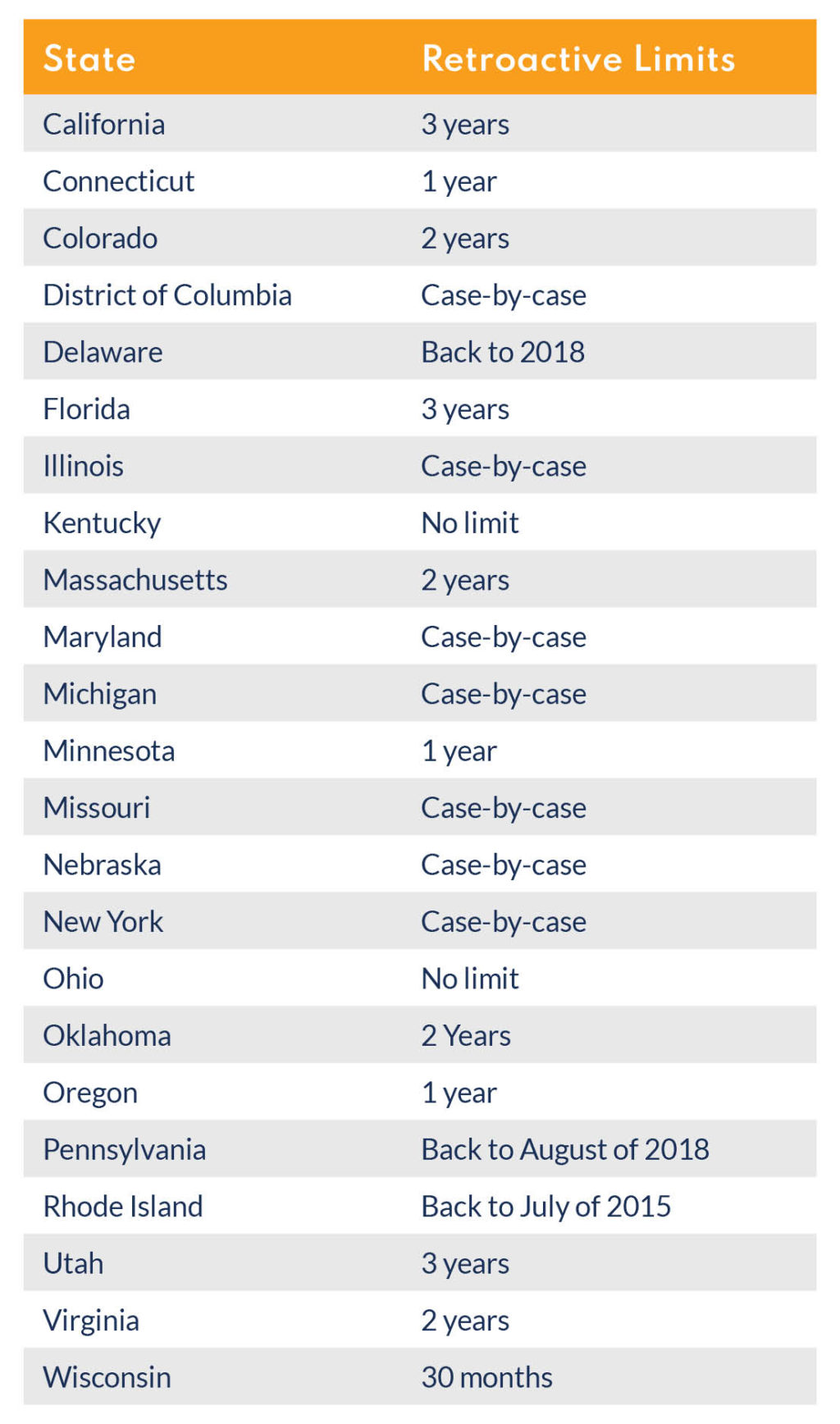

C-PACE can also be utilized to recapitalize existing projects and proceeds may be used to fund construction costs overruns, replenish operating reserves, cover existing lender debt service, and pay down existing leverage. A list of states featuring retroactivity can be found below:

Keys to Success:

There are three main obstacles you might face in a C-PACE transaction: financial sizing, the energy technical review, and first mortgage lender consent. Like most transactions, the key to success is assembling a strong team. A project developer with a good understanding of C-PACE can help you maneuver through the financial sizing and energy technical review internally.

A thorough understanding of the applicable building code will ensure that the project is designed properly and passes the technical review threshold.

Lastly, the earlier that you educate the first mortgage lender in the process, the better. Ultimately, the lender will need to sign a document consenting to the C-PACE, and you do not want to get to the finish line and then have the deal fall apart. To date over 282 first mortgage lenders have consented to C-PACE transactions.

An experienced team can help you work through each of the obstacles to ensure a streamlined and successful closing. To date, over 2,000 projects and over $1.5 billion have been financed through C-PACE.

To learn more please do not hesitate to contact Jason Schwartzberg at jason@mdenergyadvisors.com or 410-777-8144.

MD Energy Advisors demystifies energy through education and can help commercial real estate clients increase asset value by anticipating and solving their energy problems. Learn more at www.mdenergyadvisors.com or call us at 410.779.9644.