What is C-PACE?

Commercial Property Assessed Clean Energy or C-PACE can be used to finance energy-and water-related improvements of a real estate project. Budgetary items including but not limited to the HVAC, lighting, roofing and building envelope that are designed above and beyond base building code are considered qualified expenses. Renewable energy projects including solar and battery storage are also eligible for C-PACE financing.

The program starts with state-level government policy that classifies clean energy upgrades as a public benefit similar to a new sewer, water line or road. The C-PACE is repaid as a benefit assessment on the property tax bill over a term that matches the useful life of improvements and/or new construction infrastructure (typically ~20-25 years). The assessment transfers on the sale of the property and can be passed through to tenants where appropriate.

How does C-PACE work?

C-PACE reduces a project’s weighted average cost of capital. Offering approximately ~6% on terms up to 25 years, C-PACE is cheaper than both mezzanine and equity financing options. In addition, some lease structures allow assessments to be passed through to tenants. Property owners and developers can use C-PACE financing to replace equity or mezzanine debt in their capital stack. C-PACE works with various forms of financing, including traditional bank mortgage loans, federal or state historic tax credits, new markets tax credits and other tax abatement financing. Good use cases include cost constrained deals, internal cost of capital greater than 6.5% and first mortgage debt placed with regional and super regional banks.

Why use C-PACE?

C-PACE financing is fixed-rate, long-term, non-recourse, and non-dilutive. With C-PACE you will close your deal faster and increase your bottom line. In addition to offering a significantly lower cost of capital, C-PACE offers compelling benefits, including the ability to pass through the cost of the payments to tenants and serves as off-balance sheet financing.

- Efficient source of capital with no up-front, out-of-pocket costs for the property owner

- Positive cash flow and increased property values

- Alignment of landlord and tenant interests

- Cost savings generated by the improvement project can be shared with tenants under a triple-net lease structure (NNN)

- C-PACE assessment automatically transfers to the new owner upon sale

Is C-PACE right for my project?

PCG offers free consultations to assess whether your real estate project is the right fit for C-PACE financing. No scams, no sales pitch—just an honest assessment.

Projects that qualify for C-PACE

New Construction & Gut Rehabs

Energy Efficient Upgrades & Deferred Maintenance

Solar & Renewables

Retroactivity & Rescue Capital

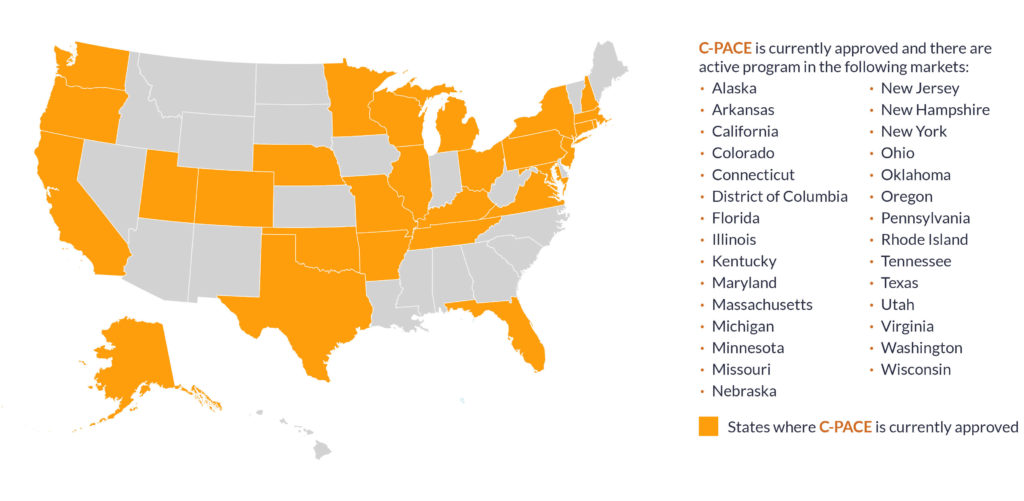

Where is C-PACE offered?