Don’t worry, we get it. C-PACE can improve your bottom line but you’re not exactly sure how this newer, innovative form of financing works. Let us help.

-

What is C-PACE?

Commercial Property Assessed Clean Energy (C-PACE) is an innovative financing structure that makes it possible for owners of commercial, industrial and other non-residential properties to obtain low-cost, long-term financing for energy efficiency, water conservation and renewable energy projects.

C-PACE authorizes municipalities or counties to work with financiers to provide upfront capital to commercial property owners for qualifying improvement projects, and to collect the repayment through annual or semi-annual assessments on the property’s tax bill. The C-PACE financing term may extend up to 25 years in some jurisdictions, resulting in utility and other cost savings that typically exceed the amount of the assessment payment, providing net benefit.

-

How long does it take to secure C-PACE financing?

It takes approximately 8 weeks to fund a C-PACE project. It takes two weeks to scope out the work and review financials, two weeks to get a signed term sheet, two weeks to gain state C-PACE administrator approval and two weeks to draft and issue the financial agreement.

-

How does C-PACE work?

C-PACE shrinks a building’s weighted cost of capital. Offering approximately 6.5% dynamic pricing* on a 20-year term and amortization, C-PACE is cheaper than both mezzanine and equity financing options. In addition, some lease structures allow assessments to be passed through to tenants. Property owners and developers can use C-PACE financing to replace equity or mezzanine debt in their capital stack. C-PACE works with various forms of financing, including traditional bank mortgage loans, federal or state historic tax credits, new markets tax credits and other tax abatement financing. Good-use cases include cost constrained deals, internal cost of capital greater than 6.5% and first mortgage debt placed with regional and super regional banks.

-

Why use C-PACE?

In addition to offering a significantly lower cost of capital, C-PACE offers compelling benefits, including the ability to pass through the cost of the payments to tenants and off-balance sheet financing.

-

Efficient source of capital with no up-front, out-of-pocket costs for the property owner

-

Positive cash flow and increased property values

-

Alignment of landlord and tenant interests

-

Cost savings generated by the improvement project can be shared with tenants under a triple-net lease structure (NNN)

-

C-PACE assessment automatically transfers to the new owner upon sale

-

-

Where can you apply C-PACE?

C-PACE can fund any item that is affixed to the property and has a positive impact on energy, water and maintenance savings. C-PACE funds can also go to associated soft costs, including architectural, engineering, permitting, general conditions and more. Common C-PACE applications include new construction, reposition and energy related capital projects.

-

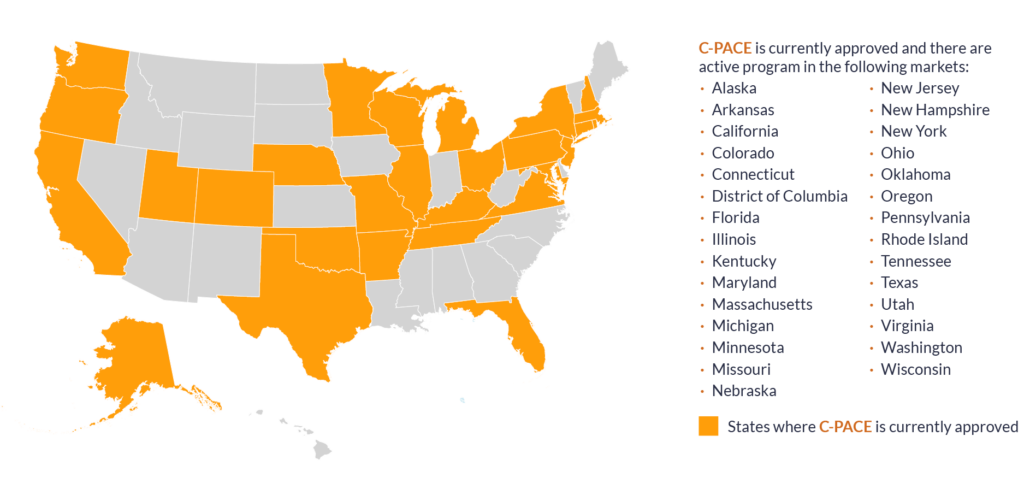

Where is C-PACE offered?

C-PACE-enabling legislation is active in 34 states plus Washington, D.C. C-PACE programs are now active (launched and operating) in 20 states plus Washington, D.C. Maryland currently has active C-PACE legislation and a C-PACE program. Different jurisdictions have different requirements (e.g., state vs. local municipalities).

MD Energy Advisors currently provides electricity and natural gas solutions in: Arkansas, California, Colorado, Connecticut, District of Columbia, Florida, Kentucky, Maryland, Michigan, Missouri, New Jersey, New Hampshire, New York, Ohio, Oregon, Rhode Island, Texas, Utah, Virginia and Washington.

- C-PACE Eligible Expenses

-

How does C-PACE financing compare to mezzanine debt?

Mezzanine debt is a more traditional form of financing, but it is also one of the highest-risk forms of debt. It typically has higher interest rates due to the minimal due-diligence involved in securing a loan. Mezzanine debt is also lower priority in regards to a company’s loan repayment obligation. C-PACE financing, however, typically has a lower interest rate because it requires consent from first mortgage lenders and increases property taxes. As a result, C-PACE is higher priority for a company’s repayment obligation but allows borrowers to retain equity. The following chart outlines how C-PACE financing compares to mezzanine debt.

-

What banks are comfortable with C-PACE?

The majority of regional and super-regional banks are PACE-friendly. If your mortgage is with a bank currently not on the list, we can educate your bank on the C-PACE program and offer them information and resources for them to consider becoming a consenting financial institution. Or, if you have questions about a specific bank, contact us to discuss further at 410.777.8144 or jason@mdenergyadvisors.com.

(Disclaimer: may not be exhaustive; as of April 2019)

-

What are the C-PACE financing parameters?

Commercial Property Assessed Clean Energy (C-PACE) is an innovative financing structure that makes it possible for owners of commercial, industrial and other non-residential properties to obtain low-cost, long-term financing for energy efficiency, water conservation and renewable energy projects. Before MD Energy Advisors secures financial underwriting for your project, you should understand the C-PACE financing parameters.

-

What documentation is required for underwriting?

Once your deal has been prequalified, MD Energy Advisors needs multiple documents for underwriting in order to secure lender commitment. For example, you should be prepared to share appraised value, an environmental report, title, energy engineering report, financial statements, term sheets and evidence of property insurance, among others.

-

How do I know if C-PACE is the right fit?

MD Energy Advisors is a true partner, and because we are uniquely qualified to help you overcome the underwriting, measurement and qualification hurdles, we can and we will tell you if C-PACE is or is not the right fit for your energy-related project. For example, one situation that would be a clear indication is if the bank with your mortgage does not consent to C-PACE financing. At that point, the project cannot move forward with C-PACE unless the building owner moves the mortgage to a C-PACE consenting financial institution. However, MD Energy Advisors can offer other services that can help you reduce energy costs after the project is complete. Complete our Getting Started Form and we can help determine if your initiative is a good candidate for C-PACE financing.

-

When should developers consider C-PACE?

As early in the project timeline as possible. To determine if your project is the right candidate for C-PACE financing, visit our Getting Started page and we’ll call you within 48 hours to discuss potential next steps.

-

When should property owners engage with MD Energy Advisors?

It takes approximately 8 weeks to secure C-PACE financing. The earlier in the process the better. Visit our Getting Started page and MD Energy Advisors will call you within 48 hours to discuss potential next steps.)

-

How do I get started?

Call us today at 410.779.9644 to discuss your upcoming energy project. Or, visit our Getting Started page and we’ll review your submission and call you within 48 hours.

-

What property types are eligible for C-PACE?

C-PACE works for all commercial properties including but not limited to office, retail, industrial, hospitality, mixed-use, and self-storage. C-PACE is not eligible for residentially zoned buildings (4 units or less), condominiums, or government-owned/municipal buildings.